11 Sep Custom electronic components, customized

The trend toward consumer-driven electronics is inevitable in electronic medical device manufacturing.

by Ranica Arrowsmith, Associate Editor, MPO, September, 2014

Calico, shorthand for California Life Company, doing business as California Life Sciences LLC, is a Mountain View, Calif.-based biotechnology company that is barely a year old. The company focuses on aging and associated diseases, although it hasn’t released any products yet. It bills itself as a “research and development company whose mission is to harvest advanced technologies to increase our understanding of the biology that controls lifespan.” The vision statement goes on to say the company will make an “unprecedented level of interdisciplinary effort” for which “funding is already in place.”

Calico, shorthand for California Life Company, doing business as California Life Sciences LLC, is a Mountain View, Calif.-based biotechnology company that is barely a year old. The company focuses on aging and associated diseases, although it hasn’t released any products yet. It bills itself as a “research and development company whose mission is to harvest advanced technologies to increase our understanding of the biology that controls lifespan.” The vision statement goes on to say the company will make an “unprecedented level of interdisciplinary effort” for which “funding is already in place.”

Well, of course funding is already in place. Did I mention Calico is a Google company?

That’s right. In September last year, Google announced the foundation of Calico, its new venture into the medical technology space. Founding investor Arthur D. Levinson, chairman and former CEO of Genentech and chairman of Apple, was named CEO.

In announcing the new investment, Google CEO Larry Page said, “Illness and aging affect all our families. With some longer term, moonshot thinking around healthcare and biotechnology, I believe we can improve millions of lives. It’s impossible to imagine anyone better than Art—one of the leading scientists, entrepreneurs and CEOs of our generation—to take this new venture forward.”

For his part, Levinson stated that he had devoted much of his life to science and technology “with the goal of improving human health.” Calico, then, was a natural evolution of his ambitions.

It’s no coincidence that a major Apple executive found his way into biotechnology. The consumer electronics giant that has taken over the world with its i-products has already poached at least half a dozen prominent biomedical experts, according to Reuters, and is recruiting more medical professionals and hardware experts, although the number of hires is not clear. Much of the hiring is in sensor technology, an area CEO Tim Cook singled out last year as primed “to explode.” Reuters sources say the moves telegraph a vision of monitoring everything from blood-sugar levels to nutrition, beyond the fitness-oriented devices already on the market.

Of all consumer devices, Apple’s have got to be the most ubiquitous. The iPod, like Scotch tape, Band Aids and Q-Tips, is well on its way to becoming the genericized word for mp3 player—if it hasn’t done so already. With the introduction of the iPhone, which does everything the iPod can do plus the functionality of a smart phone, people everywhere, from middle-schoolers to CEOs, have access to every communication function they need in one small device.

As far as health goes, there are myriad fitness and health apps, some of the most popular being Map My Run and Nike+, that can map workouts and track fitness and diet regimes. AliveCor made waves when San Diego, Calif.,-based cardiologist Eric Topol, M.D., used the portable heart monitor—which attaches to smart phones—in dramatic airline incidents where patients suffered a cardiac event while on board. The time has arrived when consumer electronic devices are doubling as medical devices, and vice versa.

“Trends you see in the consumer sector, you can anticipate will eventually appear in medical,” Vitaliy Epshteyn told Medical Product Outsourcing. Epshteyn is chief technology officer and senior director of global engineering and portfolio management for TE Connectivity’s medical business unit. TE Medical provides manufacturing and development services to medical device OEMs, and some of its core competencies are in wire, cable and custom connectors. A company such as TE Connectivity, Epshteyn said, is uniquely positioned to compete in a marketplace that looks like the world Google and Apple are creating, because alongside its medical business, it also serves the aerospace, industrial, automotive, and, among others, consumer devices and telecommunications market.

“Our consumer devices and telecommunications business is where we have a great advantage with TE Connectivity,” Epshteyn continued. “Our medical business unit is uniquely positioned to leverage those technologies. I imagine there are more barriers to our competitors because it’s tough to find such a broad spectrum of competencies in one company like TE Connectivity.”

Smaller and Smaller

The one song that any company involved in any electronic manufacturing has been singing for years is “miniaturization.” While physical dimension isn’t technically the golden rule for the way these trends go (Apple went from the clunky first generation iPod, to the Nano, to the Shuffle… to the iPad), the idea is that smaller equals better for the consumer—or the patient.

Consider the PillCam from Israeli company Given Imaging Ltd. (recently acquired by Covidien plc). The line of orally administered cameras—one that provides video of the small bowel, one for the colon and one for the esophagus—is made up of wireless cameras the size of vitamin capsules.

Consider the PillCam from Israeli company Given Imaging Ltd. (recently acquired by Covidien plc). The line of orally administered cameras—one that provides video of the small bowel, one for the colon and one for the esophagus—is made up of wireless cameras the size of vitamin capsules.

Then there’s Helius from California company Proteus Digital Health Inc., a tiny ingestible chip the size of a grain of salt that can be swallowed to track a patient’s medication regime. The sensor reports back to a transmitter the size of a Band-Aid (there’s that genericized term again) worn by the patient, and the information is then transmitted to a smart phone. Helius provides a valuable management tool for physicians with patients on complicated medicine routines, such as diabetes or cancer patients.

Miniaturization offers many benefits to the patient, as with the swallowable cameras. Smaller devices make for less-invasive procedural techniques and, therefore, less trauma during surgeries and other minor procedures. But there is also a benefit to clinicians who use medical devices, as Epshteyn noted to MPO.

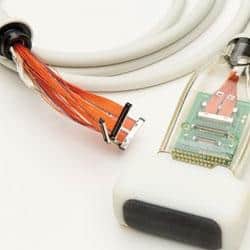

“The trend we see is miniaturization—making devices smaller and more flexible—to really minimize patient trauma and enable less hospital stay and faster release,” Epshteyn said. “The demand in general is being able to pack just as much or even more functionality into a smaller space. Take a sonographer, who is taking ultrasound images during their job all day. As you can imagine, manipulating the probe and taking images from different angles can be tiring, and is a repetitive motion. There is an ongoing demand to keep the cable limp, flexible and light to prevent those repetitive syndrome related injuries. In our ultrasound business, we recently introduced a technology that made the cable a lot smaller, lighter, and more flexible without sacrificing the image quality.”

Epshteyn couldn’t go into detail about the specific technology used to improve the ultrasound connector, called the Comfort Cable, because of a patent file, but he did call it a “breakthrough” in that market. He’s right. Studies show that sonographers do run the risk of developing carpal tunnel syndrome, tendonitis, spine problems and a veritable cornucopia of chronic pain issues. Not only is this obviously undesirable for sonographers, it costs hospitals a lot of money in the risks and claims department.

Ah yes, money talks. Miniaturization mean less material costs, less shipping costs—but also higher design and development costs. Compressing more complexity into smaller packages isn’t cheap, at least initially, and yet OEMs are demanding both compactness and cost effectiveness.

“We’re seeing a drive towards making components smaller and less expensive,” said Jason Finley, director of business development for North American Interconnect LLC (NAI), a Scottsdale, Ariz.-based wire and cable assemblies manufacturer. “We’re seeing customers really push to integrate electronics into cable assemblies. We are doing a lot more electronic components and printed circuit board assemblies in the cable assemblies themselves even on the disposable end of product—we’re over-molding electronic components and printed circuit boards right into the cable assemblies themselves.”

Cost is always a concern for OEMs, as the lower the manufacturing cost, the higher the potential profit margins. However, as much as sensational media would like us to believe that big bad electronics (medical or otherwise) corporations produce their products for cents and sell them for hundred of dollars, that simply isn’t true. Let’s go back to Apple, which in 2012 faced considerable controversy over allegations of worker mistreatment at a manufacturing facility in China. Those allegations were eventually exposed to be at least mostly untrue, but the narrative is familiar: Profitable American company makes millions on the backs of underpaid and badly treated workers in developing nations.

But the reality is that the latest iteration of the iPhone, now in its fifth generation, costs $213 to make (that figure is for the 16 GB iPhone 5S). According the breakdown from UBS AG, a Swiss global financial services company, that $213 breaks down as follows: $11.34 for sensors, $11.96 for the camera, $17.89 for the processor, $28.65 for the cellular system, $29.39 for the ambiguously categorized “other” features, $23.30 for the memory, $42.90 for the display, and $48.22 for the casing. That’s right—the pretty cover costs the most to make.

The capital that goes into appearance, both the casing and more importantly the display, is telling of market demands. Every method of electronic communication in use today, be it smart phones, computers, tablets or televisions, is in the race towards sharper defined images and even three dimensional viewing. Medical image displays are no exception.

“In the same way consumers like to upgrade their TV to see a better defined image with multiple dimensions, physicians want to see better quality images in their medical equipment,” Epshteyn said. “And if it’s three-dimensional, it just makes their procedure more valuable and efficient.”

“Reduction in component size has been the most amazing trend in the electronics market,” Joe Held, international sales manager for Omnetics Connector Corp., a Minneapolis, Minn.-based manufacturer of electronic connectors, told MPO. Along with displays, which Held pointed out have “dramatically changed from CRT (cathode ray tube) technology to thin flexible touch screen films,” the executive provided a laundry list of components that have undergone drastic miniaturization over the years.

“Semiconductors have advanced from analog to digital, therefore reducing size and power consumption,” he said. “E-skin technology has allowed components such as rechargeable batteries, sensor arrays, solar cells and OLEDs (organic light-emitting diodes) to become thin, flexible and even biodegradable. Camera lenses are rapidly shrinking while image resolution is skyrocketing into the gigapixel range. Solid state data storage continues to shrink in physical size while increasing in capacity. And, of course, the connector and cable market is following the trend with smaller, lighter, more robust cable and interconnect systems.”

Outsourcing and Offshoring

With price concerns comes the inescapable question of offshoring manufacturing. Last year, Jabil Circuit Inc. laid off more than 500 workers making printed circuit boards and box-build assemblies for the medical, industrial and aerospace sectors. “We are in the process of moving several assemblies to other Jabil facilities in Mexico and Asia in order to reduce labor costs and meet our customers’ pricing expectations,” wrote Jabil Human Resources Manager Dawn Tabelak in a petition to the Trade Adjustment Assistance. Flextronics Americas laid off approximately 150 Texas employees because their jobs were being transferred to Juarez, Mexico. TE Connectivity, too, found itself eliminating upwards of 600 jobs from its North Carolina facilities last year, and 23 jobs from its Tennessee location.

“It’s good for electronic manufacturers and suppliers to provide options,” Epshteyn said. “Not all OEMs are the same. I would say some are very sensitive to the proprietary content of their products, and they would pay premiums to keep most of their product manufacturing in the United States. Many OEMs are seeing increased cost pressures. Certain products are more commoditized than others, and there the desire is for the supplier to have a manufacturing location close to where the OEM facilities are.”

“Also having the option to manufacture in Asia is very important, as it’s a low-cost option,” Epshteyn continued. “I also think that for customers based in Asia, it is important not just to produce in Asia but also to have engineering capabilities there, and to be able to interact with OEM technical personnel. We have recently introduced a development team in China to accommodate that trend.”

While China and Asia in general is the traditional location for lower cost manufacturing, Mexico and other Central American locations are becoming an attractive middle ground for customers who want to lower costs but keep operations close to America. Epshteyn said that many OEMs now also have locations in places such as Costa Rica, so outsourcing manufacturing to Mexico “is an advantage” for them. And of course, TE Connectivity has a significant presence in Mexico, where it has been moving so many of its American jobs.

“We’re starting to see a lot more outsourcing,” NAI’s Finley said. “A lot of our major medical OEM clients are starting to want us to do more, to go higher up in the food chain and provide more value-added services. In response to healthcare reform they’re really pushing to lower costs, due to the new taxes, but also to improve patient outcomes. We’re seeing a major trend in really utilizing our global footprint to even produce the same products in multiple factories for different regions of the world. We’ll ship out of our China facility into our Asia region, then ship out of our Mexico facility to North America.”

He continued, “We’re seeing a big trend in tailoring products and making design changes for different regions of the world. We’re really trying to take care of and address emerging markets, and we’re seeing OEMs really push to tailor products to certain regions. For instance, to lower the cost of a product for an emerging market, some features might be shed that are not necessary for that market.”

Future Trends: Biocompatibility, Wearability and Beyond

Miniaturization and the trend toward consumer-friendly devices are tied to a number of other trends for customized electronic components in medical devices. In the January issue, MPO focused on how electronic medical devices are becoming more focused on wireless communication, wearability and portability. Insulin pumps such as the t:slim from Tandem Diabetes look almost exactly like a smart phone, and are optimized for home use and patient usability.

“The miniaturization trend has opened the door for designers to move from large stationary systems that confine patients to a bed to portable lightweight patient-worn devices,” Omnetics’ Held said. “These patient-worn devices give the wearer the freedom and flexibility to move around and maintain a more normal lifestyle. Diagnosis and treatment can be done at home rather than in a hospital or clinical setting.”

Omnetics’s expertise, like TE Connectivity’s, is in cables and connectors. Both companies make connectors for devices that go inside the body, such as pacemakers, catheters, surgical instruments, and various other implants. Not only do electronic components have to be visually appealing now that they are trending towards the consumer market, they also have to be biocompatible, such as is the case with the PillCam.

“This puts additional demands on cable and connector manufacturers,” Held continued. “First, there will be some level of bio-compatibility necessary. This is typically stated as requirement of ISO 10993. Patient wearability is a concern as the cables of a portable monitor may be in continuous contact with the patient’s skin for an extended period of time. The flexibility of the cable must also be taken into consideration for patient comfort. Since the connectors will likely be mated and unmated by a patient they must be easy to use and safe. This means that they are polarized and often color-coded do they cannot be plugged into the wrong receptacle. Also, the contacts carrying power must be recessed to avoid any possible shock to the patient.

OEMs also come to us with varying degrees of environmental sealing requirements ranging from IP60 (dust proof) to IP68 (waterproof). It must also be determined how a set of connectors will remain connected. Some OEMs are looking for positive locking methods such as latches or screws. Other designers want a friction fit that will break free under a certain load. The advantage in such a breakaway connector set is mainly one of safety in order to prevent trips and strangulation from the cable. Considerations should also be made for how many times the connector pair will be mated and unmated. Some OEMs require electrical connectors to withstand over 10,000 mating cycles with no loss of performance. Another common requirement is related to how the cable harness will be sterilized (chemical, heat or radiation). Materials chosen for the connector and cable harness must be able to withstand the chosen method.”

The ISO standard Held mentions is a series of standards for evaluating the biocompatibility of a medical device prior to a clinical study. More and more, contract manufacturing organizations (CMOs) such as Held’s are seeing OEMs expect more turnkey solutions so they don’t have to shop at multiple suppliers and CMOs to get what they need for a product to make it to market. NAI’s Finley noted to MPO that only a couple of years ago, NAI was creating sub assemblies of products, while the final assemblies and electrical testing was done at the OEM facilities.

“Now, instead of shipping it to their plant to do the final assembly, we’re doing that in our facility,” Finley said. “We’re now doing the advanced testing so that we’re shipping higher level goods that don’t require as much processing and work at the OEM’s facility.”

From Epshteyn’s point of view, increased regulatory activity is what is driving the trend towards OEMs expecting more from one place.

“From a business standpoint, we actually see advantages from increased FDA attention because we see our OEM customers having to allocate a lot of their resources to comply with FDA requirements,” he said.

“Sometimes it’s not just quality resources but cross-functional resources including research and development. It’s creating opportunities for suppliers like ourselves to provide more value add and partner with our customers to find solutions. If OEMs have less resources to work on product development, they’re looking to outsource it. Logistically, they would rather have a one stop shop that does all the value add versus working with five to 10 small suppliers. All of that plays in our favor because we do have significant engineering and process capabilities.”

Epshteyn sees custom electronic manufacturing at his company expanding offshore, and TE Connectivity is providing more engineering and mechanical expertise at all its global locations to provide turnkey services.

Meanwhile at Omnetics, Held sees particular growth in neurostimulation devices.

“Neuroprosthetics such as cochlear hearing aids, retinal implants, deep brain stimulation and spinal stimulation continue to advance, and we expect the need for small custom connector solutions to grow,” he said. “These implants often require terminating connectors to micro and nano-miniature electrode wire, which is a challenging process that not many manufacturers are comfortable with. These hair thin wires are often coated with tough thin coatings of polyimide or Teflon that are difficult to mechanically strip. We have proprietary methods for terminating this type of wire. Here at Omnetics we have more than 40 years of experience working on the cutting edge of the interconnect market. We are continuously pushing the envelope of size and durability. We look forward to all new challenges that await us in this exciting field.”

Images courtesy of TE Connectivity.